Why Investors Trust Us

💡 Early identification of high-growth small caps | 💡 Process-driven stock selection approach | 💡 Focus on quality over quantity |

💡 Risk-managed investment strategies | 💡 Transparent research methodology

Track Record of Identifying Rare

Wealth Creators

Our tracked opportunities have gone on to deliver exceptional long-term returns, including wealth creators that appreciated over 200x over time.

Small-Cap Research

Specialists

Our core expertise lies in discovering emerging small-cap companies before they enter the mainstream radar. We focus on strong fundamentals.

Research-Driven, Not

Noise-Driven

Every recommendation is backed by deep research, data analysis, and risk assessment — not market rumors or speculation.

Led by Certified Market Professionals

Our research is guided by experienced market professionals with strong backgrounds in financial analysis, valuation, and portfolio strategy.

Recognized & Featured

Our insights and market views have been featured on financial platforms and are followed by a growing community of serious investors.

Focused on Wealth Creation, Not Trading Noise

We specialize in high-conviction ideas for long-term capital appreciation, not short-term speculation.

Offerings

Explore our tailored services designed to meet diverse investment needs..

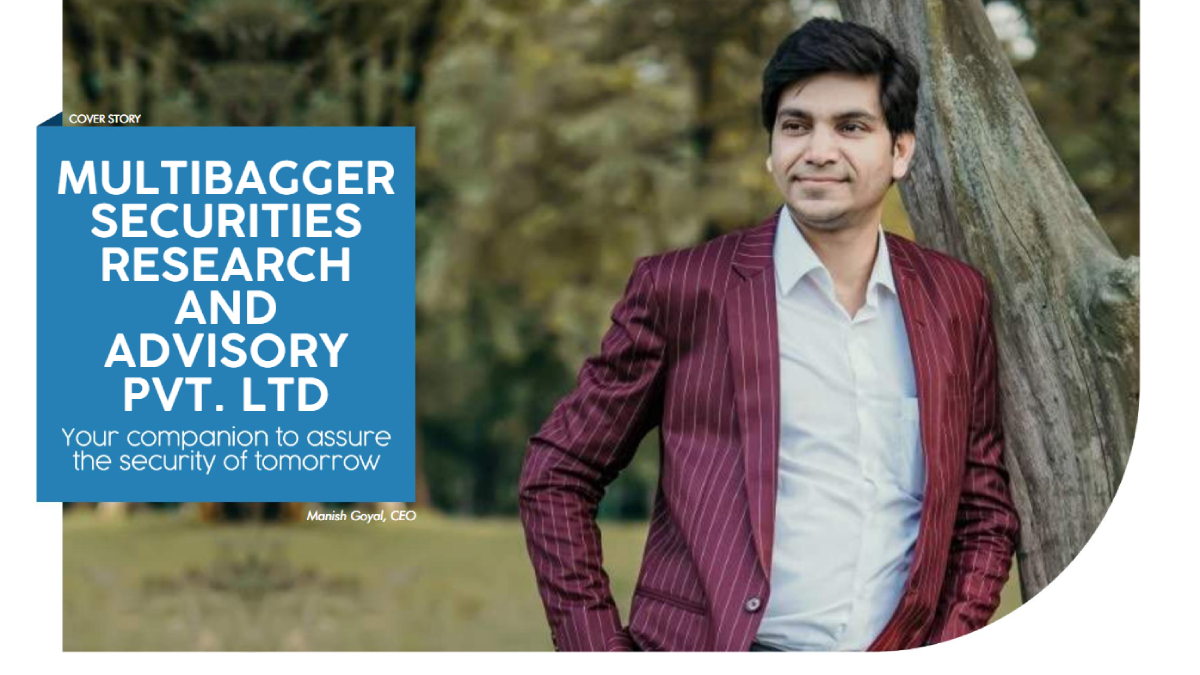

Manish Goel

Founder & Managing Director

A Chartered Accountant since 2005 and a rank holder, he has been deeply involved in investing since 2002.

After spending four years as a Finance Manager with a leading multinational company, he made a deliberate decision to step away from corporate life and focus on his true passion: value investing.

Over the years, he has experienced multiple market cycles, including strong bull runs, prolonged bear phases, and sharp market crashes. During these periods, he identified several small-cap and mid-cap companies at early stages that went on to deliver exceptional long-term returns.

What concerns him most is seeing retail investors consistently lose money by blindly following TV experts, social media hype, broker tips, and free stock recommendations. This platform was created with a clear purpose: to help investors make informed, disciplined decisions based on fundamentals.

Media Coverage

The media never fails to feature us!

Blogs

Sharing ideas, reflections, and journeys that matter to us.

Testimonial

Principles of Smart Long-Term

Investing

Investors must know this: Spotting a cheap stock is not simple. Making money is hard anywhere – and extra hard in the stock market.

Millions of people, big foreign funds (FIIs), and mutual funds (MFs) study thousands of companies every day. When we spot a huge winner like Chaman Lal Setia – a 40-times gainer – it means we beat all those pros. That’s no small win!

To find these hidden gems, you need great skills in finance and ratios. But 99% of investors only know basics, like PE or P/B ratios. They lack the full know-how.

So, don’t pick stocks on your own and risk losing big. Instead, team up with a true expert who has a strong track record.

Think about it: When sick, you see a doctor. In a legal mess, you call a lawyer. So why handle stocks alone if it’s not your skill?

If just reading books made top investors, librarians would be the world’s richest. Investing takes way more than what you see on the surface.

In markets, 99% lose cash – and that cash goes straight to the smart 1%. But if you follow that 1%’s ways, you can jump from the losing side to the winning team.

Remember this old wisdom: “If you can’t spot the jewel, know the jeweller!”

Always base your investments on the true fair value of a stock. I have seen that most people pick stocks using pointless ideas, like “it’s up from its 52-week low,” “it’s down from its 52-week high,” or “technical support and resistance levels.” These don’t matter at all.

The right way? First, figure out the fair value of a stock. If the current price is below that value, buy it. If it’s above, sell it.

I notice this a lot: When a stock jumps 30-40% in just a few days, investors hold back. They wait for it to drop, as if the price will fall just for them to buy cheap! That’s a mistake.

Instead, just check the current market price against its fair value. Then decide what to do. This simple step keeps you safe and smart.

Never buy stocks on margin. Also, don’t take a bank loan to buy shares. Only put in cash that you won’t need for at least the next two years. This keeps your money safe and your mind at peace.

Do not fall in love with IPOs….. IPOs are generally overpriced.

I have seen something odd: If a Rs 50 stock jumps to Rs 100 in just one month, investors suddenly love it. They rush to buy at Rs 100. But the same people skipped it when it was Rs 50!

Here’s the truth: When a stock doubles so fast, it gets less appealing for buying. Quick rises often mean the price is already too high.

Keep this Warren Buffett tip in mind: “Buy stocks like you buy groceries—not like you buy perfume.” (Shop for deals on basics, not fancy hype.) and remember his other wise words: “Price is what you pay. Value is what you get.” Focus on real worth, not just the tag.

Look Beyond Blue-Chips for Real Wealth

Don’t get stuck loving only big blue-chip companies if you want to build true wealth in the stock market. Real riches come from small-cap and mid-cap stocks.

Remember, when Rakesh Jhunjhunwala bought Titan, it was just a small-cap stock. Today, Reliance trades at around Rs 1,450. Do you think it can hit Rs 20,000 in three years? No chance!

But top-quality mid-cap stocks can grow 10 or 20 times in a few years. For example, HDFC Bank took 15 years (2003 to 2018) to jump 40 times—from Rs 50 to Rs 2,000. Yet, my pick Chaman Lal Setia did the same 40 times in just four years (2014 to 2018)—from Rs 5 to Rs 200.

I see investors wasting time and money chasing only blue-chips. Instead, hunt for solid small-cap and mid-cap stocks, then hold them tight for years.

If you entered the stock market, you came to multiply your money—not settle for 10-20% gains. For those small returns, try safe options like bank fixed deposits.

I have noticed this: When an investor buys a stock, he checks the price right away. He hopes it jumps up fast, like the stock was waiting just for him to buy it.

That’s not smart. Focus on how the business is doing, not on small daily changes in price. If the company grows strong, the stock price will catch up in time. Patience pays off.

I have seen this too: When an everyday investor buys a stock and it goes up just 10-15%, he sells fast to lock in the gain. This quick-sell habit stops them from building real wealth.

Warren Buffett bought Coca-Cola shares in the last century, and he still holds them today. If he had sold after only 20-30% profit, he’d still be a small-time investor.

The key to smart fundamental investing? If you spot a true winner, buy it and let it sit for years. Don’t check the price every day. Why? Daily ups and downs will tempt you to act—and that’s a trap. Stay patient, and watch it grow.

Skip Charts – Stick to Basics

Here’s a funny truth: One way to end up with $1 million is to start with $2 million and follow technical charts!

So, don’t waste time on technical analysis. The real key to stock market wins is fundamental analysis.

If just reading charts made big money, the world’s richest folks would all be chart drawers or math geeks.

Take this real example: On April 2, 2014, I picked Chaman Lal Setia Exports (BSE 530307) using basic checks. It traded at Rs 5.5 back then (after adjusting for a later 5:1 split and bonus).

Check its charts from that day—no sign from technical tools said it would climb. But it broke all those rules. The stock locked at upper limits day after day and jumped 41 times in value in less than four years.

Skip MFs and Real Estate for Big Wins

Don’t put money into mutual funds or real estate if you want multibagger gains. Mutual funds have never turned into multibaggers in just four years. After India’s high inflation, their real yearly returns are only 5-10%.

Real estate’s future looks weak after demonetisation. I believe the old boom came from black money. In my view, it won’t give strong returns in the next 5-10 years. If you bought property just for investment, I suggest selling it now and moving that cash into top-quality small-cap stocks.

Commodity and forex trading? I see them as pure gambles, not real investing.

The biggest wealth in India over the coming years (2025-2030) will come from smart, long-term bets on quality stocks.

If you like SIPs, go ahead—do monthly ones in those same strong small-cap stocks for years.

From a life-quality angle, investing beats any job. Your money works while you stay free. What’s the point of a big salary if you’re stuck in a chair from 9 a.m. to 6 p.m.? Money matters, but so does time to enjoy it. How long will you grind for your boss to get rich? Start working for yourself. Invest in the stock market!

Build Your Kids’ Bright Future

You can shape a strong future for your children with smart long-term investing. Put 10-20 lakhs into top-quality stocks for your young ones. If you don’t have that much ready, start a monthly SIP in just a few solid small or mid-cap stocks.

This money will cover big needs like their education and wedding costs down the road.

By 2026, the Sensex could climb to 1,00,000—yes, one lakh! Back in October 2013, when Sensex was at 19,000, I called it would hit 30,000 in two years. Check the ‘Previous Calls at Discussion Board’ page—it did just that.

Even today, plenty of small caps can grow 10-20 times by 2030. Strong fundamental stocks don’t always follow the Sensex or Nifty. They can multiply over time, even if the big indices stall.

Why? In the long run, stock prices follow a company’s earnings, not market moods. If profits keep rising fast, the price must go up—no matter where Sensex sits.

In a bull run, everyday investors often pause after a big jump. They wait for a dip to buy (but it may never come!). Truth is, stocks aren’t too high to buy if the basics look good. Jump in when the chance fits!

Average Down in True Gems Only

For top-quality stocks, add more shares when the price falls—not when it rises.

But keep this in mind: Real quality stocks are rare in the market. A stock doesn’t turn “quality” just because TV or online tips push it, or management brags about orders and forecasts on air, or your broker nudges you to buy, or profits look good on paper, or media blasts positive news.

Never add shares just because the price drops. Dumping money into a weak company can wipe you out big time.

Spotting true winners takes years of hands-on know-how and sharp thinking.

Forget Volume and Price Hype

Trading volume in a stock means nothing about its future growth. In fact, the biggest winners I spotted started with very low trading when they were just beginning their climb.

One big myth: Investors think cheap penny stocks (like Rs 1-10 shares) turn into huge multibaggers more than pricey ones. Wrong! A Rs 10 stock can crash to Rs 1. But a Rs 500 stock can soar to Rs 5,000.

Also, price tricks the eye. A “cheap” stock might have a massive market cap—thousands of crores. While a “expensive” one could be tiny, just hundreds of crores.

When picking top small-cap stocks, ignore the share price. Look at market cap instead. That’s the real measure of size and potential.

Skip Free Tips and Cheap Traps

Never put your money into stocks based on free tips, SMS alerts, or those “free or cheap trial” deals from websites. If you chase free or low-cost advice, you’ll soon lose your cash. Remember: You get what you pay for.

Sure, skipping paid advice saves a small fee upfront. But it risks your whole portfolio. You might save rupees, but you’ll lose nights of good sleep.

Let me explain how these “free trial” traps work. Some sites give free picks that pump up 10-15% in days. Then they push you to pay for more. You sign up because the free one worked. But the paid picks crash hard after.

Good news: SEBI already banned these free trials for investment advisors back in 2019, knowing the scams involved. So, cheap tips can still cost you big in the market.

Don’t act on calls from tip sellers on your phone or random SMS. And skip your broker’s stock picks too—they’re often just sales talk. Stick to proven, paid experts for real peace of mind.

Say No to Day Trading

Never try intraday trading or day trades in futures and options. You can’t make steady money from it. In the end, you’ll lose everything.

Even if luck gives you a win once in a while, you’ll pay ongoing fees to tip givers, brokerage to your broker, and taxes at your income slab rates—up to 30% or more, plus extras like STT.

With long-term investing, you skip those repeat tip costs. Brokers like Zerodha charge zero brokerage on stocks you hold long-term. And the government taxes gains at just 12.5% (after Rs 1.25 lakh exemption)—way less hassle and cost. Choose the steady path to real growth! !!

Cut Losses Without Delay

One last big lesson: Investors hate to sell a stock when it’s down. They hold on tight, hoping it bounces back.

But listen: A stock’s true fair value shifts with the company’s health and big economic changes. The market doesn’t care about what you paid. A loser won’t climb just to save your feelings!

Take Unitech: Some bought it at Rs 500 and skipped selling at Rs 400—too scared of the loss. Now, it’s trading at just Rs 7. They’re hurting bad.

If you buy on your own and later see it was a wrong pick, sell fast and take the hit. That small loss? You’ll make it back—and more—in solid quality stocks from trusted experts.