Below were the reasons why I bought Suraj Products ltd (BSE Code 518075) –

1 .Warren Buffett always says that the most important thing to look before buying a stock is “Management Quality”. I fully agree with this statement of Warren Buffett. All other strengths of a stock is useless if the Management Quality and Integrity is doubtful or sub standard. Suraj Products’ Promoter & Managing Director Mr Y. K. Dalmia is well known figure in the Sponge Iron industry. He is a Chartered Accountant & Company Secretary and therefore have very good understanding of numbers/finance which is good for the future profitability of the company.

2. Excellent Return on Equity of 29%

3. Excellent and consistent Cash Flow.

4. Promoter Holding is approx 74% and it increased over the last few Years.

5.Very Less Debt and also Debt is reducing over the years.

6. PEG Ratio was just 0.21 which signified that it was highly undervalued.

7. Compounded sales growth in last 5 years was an impressive 32%.

8. Cash equivalents available in books was 38 crores which can be used for expansion.

9. Inventory Days, Cash Conversion Cycle and Working Capital Days have reduced significantly in last 10 years which shows excellent Working Capital management by the company.

10. Company has delivered a good profit growth of 48.7% CAGR over the last 5 Years.

11. Operating Profit margin improved from 10% to 16% in last 10 Years

12. Market Capitalisation of the company was only 300 crores and therefore big scope of increasing market/industry share.

13. Indian Govt is spending hugely on Infrastructure i.e. Roads, Construction, Brides, Real Estate etc and all of these sectors need TMT Bars and Steel which Suraj Products ltd manufactures.

14. There is a misconception among investors that low value stocks are bigger Multibagger…. This is completely foolish thinking… current price of a stock has no relation with its potential… Instead of current price, always look at Market Capitalisation… Now for example, current price of Suraj Products ltd was close to 300 rs, but its Market Capitalization was just 300 crores approx….. On the other hand, current price of Vodafone Idea is just 15 rs and its Market Capitalisation is 70,000 Crores !!!.. So, does the low price of 15 rs make Vodafone Idea stock a bigger Multibagger ? No… In last 16 years Vodafone Idea stock only destroyed investors’ wealth…. On the other hand, Suraj Products ltd touched Fresh Life Time High after my buying… So, You should understand the difference between low stock price and low Market Capitalisation.. I hold Suraj Products ltd for long term.

15. Beauty of Long Term Investing – I gave buy call at HLE Glascoat (Swiss Glascoat) in 2014 at 38 rs…. After 7 Years, its price touched 7600 in 2021 (taking split/bonus etc in factor) … So, it Multiplied 200 Times in 7 Years !!… If 10 lacs invested in it, it became 20 Crores in just 7 years… And no brokerage, no STT, no spread cost and only 10% Income Tax.

16. Suraj Products Ltd derive major strength from the very favourable location of its plant in terms of proximity to key raw material sources like ore iron, coal and magnesium. Odisha has high-quality iron ore deposits and it has the highest share in the production of iron ore in India

17. Significant portion of the company’s total thermal coal requirements for manufacturing sponge iron is met from the linkages obtained through auctions, keeping the landed cost of coal competitive and enhancing raw material security.

18. Company has gradually changed the product mix from sponge & pig iron to a rolling mill, which allows the company to sell more TMT bars and value-added products

19. Vertically integrated nature of operations with the capacity to manufacture sponge iron, pig iron, billets and TMT bars – Billets are manufactured using captive sponge iron and pig iron. The manufactured billets are then subjected to rolling to produce TMT bars of the desired profile. In addition, a significant portion of the company’s total thermal coal requirements for manufacturing sponge iron is met from the linkages obtained through auctions, keeping the landed cost of coal competitive and enhancing raw material security

20. Presence of a captive power plant ensures the availability of power at a cheap rate. The steel melting operation is highly power intensive. However, energy generated through captive power plants at a cheap rate meets the major part of its overall power requirement, which positively impacts the cost structure

21. The company is expanding its captive power generation capacity from 6 MW to 9 MW. The additional power generation capacity will meet most of the incremental power demand arising out of the increased scale of operations. In coming quarters it will further strengthen the operating profile of the company and enable sizeable cost savings

22. The entire portion of the recent capex was funded through internal accruals, it is expected to give healthy cash generation in the near future

23. Fantastic past numbers across sales, profit and ROE. OPM have gone from single digits to double digits from FY2018. They are also paying dividends from the last two years

24.The central government’s call for Aatmanirbar Bharat has given a whole new dimension to the nation. Steel is a vital component of national development. The various sectors that are expected to contribute to the growing demand are infrastructure, smart cities, sagarmala projects, bridges, airports, industrial plants, buildings, automobiles, new roads and highways, railways, cargo terminals, National Ropeways Development Program for hilly areas and housing projects. etc all are expected to create steel demand, which will augur well for the steel industry.

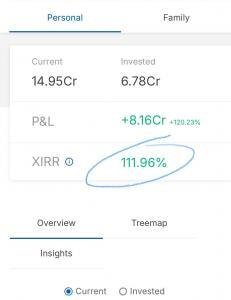

25. Therefore, I invested highest weightage of my personal portfolio in Suraj Products ltd for long term.